How Does Ucsd Pension Calculator Work? Get Answers

The University of California, San Diego (UCSD) pension calculator is a valuable tool designed to help eligible employees estimate their retirement benefits. This calculator is part of the university's broader effort to support the financial planning and security of its staff. Understanding how the UCSD pension calculator works can provide insights into planning for retirement and navigating the complexities of pension benefits.

Overview of the UCSD Pension Plan

The UCSD pension plan, like other University of California plans, is managed by the University of California Retirement Plan (UCRP). The UCRP is a defined benefit plan, meaning that the amount of retirement benefit an employee receives is determined by a formula, rather than the contributions made to the plan. This formula typically considers factors such as the employee’s years of service and final compensation.

Key Components of the UCSD Pension Calculator

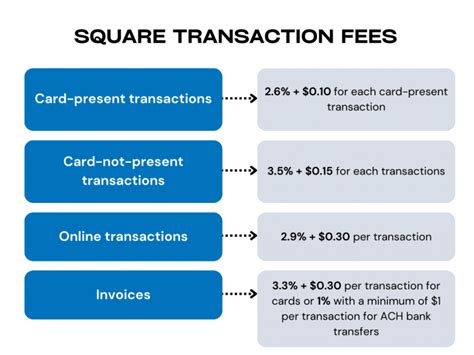

The UCSD pension calculator is designed to estimate an employee’s potential retirement benefits based on several key pieces of information. These components typically include:

- Years of Service: The number of years the employee has worked for the University of California. More years of service generally result in a higher pension benefit.

- Final Compensation: The average of the employee’s highest 36 months of compensation, which is used in the pension benefit formula. Higher final compensation results in a higher pension benefit.

- Age at Retirement: The age at which the employee plans to retire. Earlier retirement may result in reduced benefits, while retiring at or after the normal retirement age (usually 65) may provide full benefits.

- Benefit Formula: The specific formula used by the UCRP to calculate pension benefits. This formula may vary depending on the employee’s tier within the plan and when they were hired.

| Component | Description |

|---|---|

| Years of Service | Determines the multiplier in the benefit formula |

| Final Compensation | Affects the base amount used in the benefit calculation |

| Age at Retirement | Influences the percentage of final compensation received as a pension |

| Benefit Formula | The actual calculation method for determining pension benefits |

How to Use the UCSD Pension Calculator

Using the UCSD pension calculator involves entering the required information into the tool. This includes the employee’s current age, years of service, current compensation, and the age at which they plan to retire. The calculator then uses this information, along with the UCRP’s benefit formula, to estimate the monthly pension benefit the employee might receive upon retirement.

Benefits of Using the UCSD Pension Calculator

The UCSD pension calculator offers several benefits to employees:

- Retirement Planning: Helps employees understand how different retirement ages and compensation levels might affect their pension benefits.

- Financial Clarity: Provides a clearer picture of what an employee can expect in terms of retirement income, which is crucial for making informed financial decisions.

- Goal Setting: Allows employees to set realistic retirement goals and work towards achieving them.

What is the UCSD Pension Calculator used for?

+The UCSD Pension Calculator is used to estimate an employee’s retirement benefits based on their years of service, final compensation, and age at retirement.

How does the UCSD Pension Calculator account for different retirement ages?

+The calculator adjusts the estimated pension benefits according to the age at which the employee plans to retire, considering factors like early retirement reductions or full benefits at normal retirement age.

Can the UCSD Pension Calculator be used for actual retirement planning decisions?

+While the calculator provides estimates and insights, it should be used in conjunction with professional advice from a retirement planner or a University of California benefits expert to make informed decisions about retirement.